European EMS Market Experiences Double Digit Negative Growth in 2024, but may Experience Slight Positive Growth in 2025

by Sanjay Huprikar, president, IPC Europe and South Asia operations

Key Summary

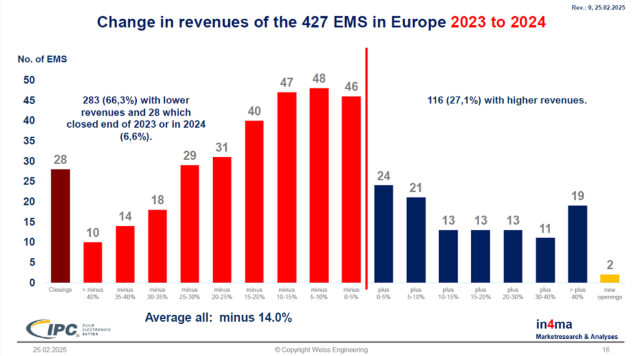

• An in4ma survey sponsored by IPC found that European EMS PCBA production shrank by 14 percent in 2024.

• Participation hit a record 427 companies, with the top 136 firms representing 81 percent of the market, even though they are only 7 percent of all companies.

• Half of all EMS sites are located in Germany, France, and the United Kingdom, and about 67 percent of companies saw lower revenues in 2024.

• Germany’s EMS industry declined 18 percent overall, with weakness in automotive, industrial, and measuring and instrumentation, but double digit growth in aerospace, agriculture, and household electronics.

• Headcount across the industry fell by 2 percent on average, yet the market is projected to grow by 3 percent in 2025.

As revealed this week by an annual survey conducted by in4ma and sponsored by IPC, the electronics manufacturing services (EMS) industry in Europe experienced negative 14 percent growth in printed circuit board assembly (PCBA) production in 2024.

While it was a very challenging year for the industry, Dieter Weiss, founder and president of in4ma, and lead architect of the survey, was able to motivate 427 companies to contribute data to this year’s survey, which was a record level of participation and represented a doubling of overall participants and a tripling in non-DACH participants in just three years.

Key industry takeaways and extrapolations from this survey and analysis included:

The top 136 companies made up only 7 percent of the overall companies, but were responsible for 81 percent of the European market

50 percent of all the EMS sites in Europe were in Germany, France, and the United Kingdom

Nearly 67 percent of the participating companies experienced lower revenues in 2024 vs. 2023

Germany’s EMS industry experienced negative 18 percent growth overall driven mainly by the automotive, industrial, and measuring and instrumentation electronics verticals, but also showed positive double-digit growth in the aerospace, agriculture, and household electronics verticals

On average, headcount across the European EMS industry was down two percent

Overall prognosis for 2025 is that the European EMS market could grow by three percent

The 88-page report contains country specific detailed data and metrics on order backlog, inventory, revenue per head, export ratios, and much more. Weiss plans to formally share his findings and analysis in detail at two live presentations in June:

IPC UK EMS Executives Meeting – London, UK – June 12

in4ma EMS & PCB Forum – Bonn, Germany – June 26

The full report “Annual Survey of the European EMS Industry 2025” authored by Dieter G. Weiss and Dr. Mareike Haass can be purchased directly from in4ma at www.in4ma.de. Contact Weiss or Dr. Haass at weiss@in4ma.de or haass@in4ma.de for additional information.

IPC fully champions the Pan-European EMS industry by focusing on standards, education, training and certification, advocacy, technology solutions, industry intelligence, and networking events. You can learn more about how to participate in these initiatives by contacting Philippe Leonard, senior director, IPC Europe, at philippeleonard@ipc.org.

According to the in4ma survey, printed circuit board assembly production in the European EMS industry declined by 14 percent in 202

According to the in4ma survey, printed circuit board assembly production in the European EMS industry declined by 14 percent in 202

A record 427 companies contributed data, doubling overall participation and tripling non DACH participation compared to three years ago.

The top 136 companies account for only 7 percent of all firms yet generate 81 percent of the European EMS market, and 50 percent of EMS sites are in Germany, France, and the United Kingdom.

Germany saw an 18 percent overall decline, driven mainly by automotive, industrial, and measuring and instrumentation electronics, but reported double digit growth in aerospace, agriculture, and household electronics.

The survey’s overall prognosis is that the European EMS market could return to slight positive territory, with potential growth of 3 percent in 202