Electrical Wire Processing Technology Expo (EWPTE) Named in Trade Show Executive’s Top 100 List of Fastest Growing Shows of 2024

IPC/WHMA and Baird Center announce that for the second consecutive year, Electrical Wire Processing Technology Expo (EWPTE) has been recognized as a top 100 fastest growing show in the United States for net square footage and number of exhibiting companies by Trade Show Executive.

EWPTE, the cable and wire harness industry’s exclusive trade show, drew 213 exhibitors in 2024 (up from 185 in 2023) who showcased their products and services over 50,100 net square feet of show floor space (up from 43,400 in 2023). EWPTE 2024 grew by 15 percent in both number of exhibiting companies and net square footage of show floor space.

“EWPTE’s growth demonstrates its increasing value to the wire harness manufacturing industry,” said Alicia Balonek, IPC senior director of trade shows and events. “This recognition confirms the show’s status as a must-attend event for cable and wire harness industry professionals.”

“The long-awaited Baird Center modernization and expansion opened in May of 2024, which now brings our exposition hall to 300,000 contiguous square feet,” said Megan Seppmann, vice president of sales at the Wisconsin Center District. “Milwaukee and the region are an ideal hub of manufacturing innovation, and now the expanded Baird Center ensures that the programming and experience for EWPTE clients and guests will continue to expand. The growth of EWPTE in this area has only begun and we can’t wait to welcome everyone through our doors in May.”

EWPTE 2025, to be held May 6-8, 2025, in Milwaukee, Wis., will feature a show floor hosting the industry’s leading suppliers and product innovators, a range of professional development courses, and technical conference sessions presented by engineers, researchers, academics, technical experts, and industry leaders will provide new technical data and significant results from experiments and case studies and share new techniques and trends of interest.

Brian Schneider, an engineering manager for routed systems at Harley-Davidson Motor Company, will present this year’s keynote address, “Modern Technology Meets Legacy: Harley Davidson’s Wire Harness Integration,” on Wednesday, May 7. Schneider will provide insight into the technology advancements of Harley-Davidson motorcycles, the impacts of wire harness construction, and how Harley-Davidson integrates advanced wire harness technology to meet modern customer demands while preserving the iconic look, sound, and feel that define the brand.

For more information, visit www.electricalwireshow.com.

European EMS Market Experiences Double Digit Negative Growth in 2024, but may Experience Slight Positive Growth in 2025

by Sanjay Huprikar, president, IPC Europe and South Asia operations

Key Summary

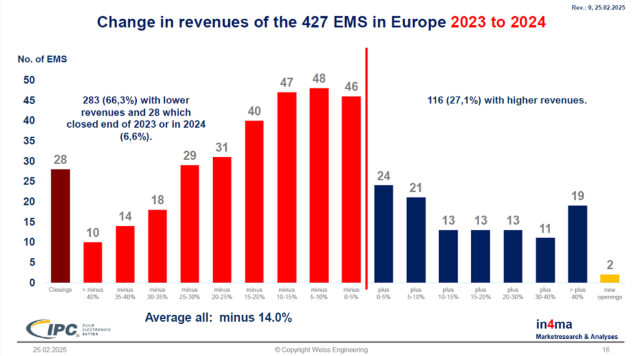

• An in4ma survey sponsored by IPC found that European EMS PCBA production shrank by 14 percent in 2024.

• Participation hit a record 427 companies, with the top 136 firms representing 81 percent of the market, even though they are only 7 percent of all companies.

• Half of all EMS sites are located in Germany, France, and the United Kingdom, and about 67 percent of companies saw lower revenues in 2024.

• Germany’s EMS industry declined 18 percent overall, with weakness in automotive, industrial, and measuring and instrumentation, but double digit growth in aerospace, agriculture, and household electronics.

• Headcount across the industry fell by 2 percent on average, yet the market is projected to grow by 3 percent in 2025.

As revealed this week by an annual survey conducted by in4ma and sponsored by IPC, the electronics manufacturing services (EMS) industry in Europe experienced negative 14 percent growth in printed circuit board assembly (PCBA) production in 2024.

While it was a very challenging year for the industry, Dieter Weiss, founder and president of in4ma, and lead architect of the survey, was able to motivate 427 companies to contribute data to this year’s survey, which was a record level of participation and represented a doubling of overall participants and a tripling in non-DACH participants in just three years.

Key industry takeaways and extrapolations from this survey and analysis included:

The top 136 companies made up only 7 percent of the overall companies, but were responsible for 81 percent of the European market

50 percent of all the EMS sites in Europe were in Germany, France, and the United Kingdom

Nearly 67 percent of the participating companies experienced lower revenues in 2024 vs. 2023

Germany’s EMS industry experienced negative 18 percent growth overall driven mainly by the automotive, industrial, and measuring and instrumentation electronics verticals, but also showed positive double-digit growth in the aerospace, agriculture, and household electronics verticals

On average, headcount across the European EMS industry was down two percent

Overall prognosis for 2025 is that the European EMS market could grow by three percent

The 88-page report contains country specific detailed data and metrics on order backlog, inventory, revenue per head, export ratios, and much more. Weiss plans to formally share his findings and analysis in detail at two live presentations in June:

IPC UK EMS Executives Meeting – London, UK – June 12

in4ma EMS & PCB Forum – Bonn, Germany – June 26

The full report “Annual Survey of the European EMS Industry 2025” authored by Dieter G. Weiss and Dr. Mareike Haass can be purchased directly from in4ma at www.in4ma.de. Contact Weiss or Dr. Haass at weiss@in4ma.de or haass@in4ma.de for additional information.

IPC fully champions the Pan-European EMS industry by focusing on standards, education, training and certification, advocacy, technology solutions, industry intelligence, and networking events. You can learn more about how to participate in these initiatives by contacting Philippe Leonard, senior director, IPC Europe, at philippeleonard@ipc.org.

According to the in4ma survey, printed circuit board assembly production in the European EMS industry declined by 14 percent in 202

According to the in4ma survey, printed circuit board assembly production in the European EMS industry declined by 14 percent in 202

A record 427 companies contributed data, doubling overall participation and tripling non DACH participation compared to three years ago.

The top 136 companies account for only 7 percent of all firms yet generate 81 percent of the European EMS market, and 50 percent of EMS sites are in Germany, France, and the United Kingdom.

Germany saw an 18 percent overall decline, driven mainly by automotive, industrial, and measuring and instrumentation electronics, but reported double digit growth in aerospace, agriculture, and household electronics.

The survey’s overall prognosis is that the European EMS market could return to slight positive territory, with potential growth of 3 percent in 202

Statement on Clean Industrial Deal and Omnibus Package

The following statement can be attributed to Alison James, Senior Director, IPC European Government Relations:

The high regulatory and administrative burden in Europe has led to a decline in European competitiveness for the electronics industry in recent years. IPC has long advocated for a 25% reduction in regulations and smarter policies that drive both sustainability and industrial growth. The European Commission’s new omnibus regulations and Clean Industrial Plan are steps in the right direction, but more must be done. While the regulations provide needed compliance delays, due diligence requirements remain overly complex and misaligned with policy goals. IPC supports the Clean Industrial Plan’s investment ambitions in clean manufacturing but urges a stronger focus on competitiveness and resilience. From the ‘made in Europe’ criteria in public and private procurements, to the mobilization of €50 billion under InvestEU, this moment presents an opportunity to rectify the strategic disadvantages that the European electronics manufacturing industry is facing. As the proposals advance, IPC will continue pushing for policies that balance sustainability with a thriving European electronics industry.

Quote:

“Today’s announcements aim to rectify the strategic disadvantages that have made it difficult for European industry to grow and compete. The electronics sector will require their roll-out with urgency. We want these initiatives to live up to their promise and are here to help," said Alison James, Senior Director, IPC European Government Relations.

European EMS Market Experiences Double Digit Negative Growth in 2024, But May Experience Slight Positive Growth in 2025

As revealed this week by an annual survey conducted by in4ma and sponsored by IPC, the electronics manufacturing services (EMS) industry in Europe experienced negative 14 percent growth in printed circuit board assembly (PCBA) production in 2024.

“While it was a very challenging year for the industry, Dieter Weiss, founder and president of in4ma, and lead architect of the survey, was able to motivate 427 companies to contribute data to this year’s survey, which was a record level of participation and represented a doubling of overall participants and a tripling in non-DACH participants in just three years,” stated Sanjay Huprikar, president, Europe and South Asia operations.”

Key industry takeaways and extrapolations from this survey and analysis included:

The top 136 companies made up only 7 percent of the overall companies, but were responsible for 81 percent of the European market

50 percent of all the EMS sites in Europe were in Germany, France, and the United Kingdom

Nearly 67 percent of the participating companies experienced lower revenues in 2024 vs. 2023

Germany’s EMS industry experienced negative 18 percent growth overall driven mainly by the automotive, industrial, and measuring and instrumentation electronics verticals, but also showed positive double-digit growth in the aerospace, agriculture, and household electronics verticals

On average, headcount across the European EMS industry was down two percent

Overall prognosis for 2025 is that the European EMS market could grow by three percent

The 88-page report contains country specific detailed data and metrics on order backlog, inventory, revenue per head, export ratios, and much more. Weiss plans to formally share his findings and analysis in detail at two live presentations in June:

IPC UK EMS Executives Meeting – London, UK – June 12

in4ma EMS & PCB Forum – Bonn, Germany – June 26

The full report “Annual Survey of the European EMS Industry 2025” authored by Dieter G. Weiss and Dr. Mareike Haass can be purchased directly from in4ma at www.in4ma.de. Contact Weiss or Dr. Haass at weiss@in4ma.de or haass@in4ma.de for additional information.

IPC, the global electronics association, fully champions the Pan-European EMS industry by focusing on standards, education, training and certification, advocacy, technology solutions, industry intelligence, and networking events. You can learn more about how to participate in these initiatives by contacting Philippe Leonard, senior director, IPC Europe, at philippeleonard@ipc.org.

Workforce Funding for EMS Companies: Opportunities Amidst Uncertainty

Key Summary

• Federal grant freezes have created uncertainty, but strong state level programs still support EMS workforce training

• Apprenticeship and employer led training initiatives continue to receive state funding for advanced manufacturing

• EMS small and mid sized businesses can access grants for workforce expansion, equipment, and operational growth

• Semiconductor and electronics reshoring efforts are generating new training funds tied to CHIPS and state programs

• IPC helps EMS companies identify grants, apply for funding, and build strategies to support upskilling and workforce development

The funding landscape for workforce development is evolving. While federal grant freezes and shifting policies have introduced some uncertainty, there are still viable opportunities available for companies in the electronics manufacturing services (EMS) industry. As the Director of Workforce Grants and Funding at IPC, I am committed to assisting EMS companies in identifying and securing state and local funding sources to support workforce training, apprenticeship programs, and upskilling efforts.

Challenges in Federal Workforce Funding

Recent federal actions, including temporary grant freezes and shifting priorities, have impacted funding for workforce initiatives. However, the National Science Foundation (NSF) and various state workforce agencies continue to support training programs, ensuring that employers in electronics manufacturing can access resources to develop skilled labor.

While some federal workforce funding is in flux, state-level grants remain strong. Many states are stepping in to expand apprenticeship programs, support small businesses, and invest in advanced manufacturing training—all of which directly benefit EMS companies.

Key Workforce Funding Trends for the EMS Industry

Despite the current federal funding climate, EMS companies have several opportunities to leverage state and industry-driven programs:

Apprenticeships & Employer-Led Training for Advanced Manufacturing

State funding for apprenticeship and upskilling programs remains a key priority. IPC actively supports apprenticeship expansion for electronics assembly and PCB design, fabrication and assembly, helping employers access funding for structured training programs.

Small Business & Supply Chain Support

Many EMS companies operate as small to mid-sized businesses within the supply chain. States continue to offer grants for workforce expansion, equipment purchases, and operational growth, helping manufacturers scale their production capabilities.

Infrastructure Investments in Semiconductor & Electronics Manufacturing

With ongoing investments in reshoring initiatives, domestic semiconductor and PCB production is growing, creating new funding opportunities for workforce training. Programs tied to the CHIPS Act and state economic development initiatives can help EMS companies train employees for high-tech manufacturing jobs.

STEM & Technical Education Partnerships

Electronics manufacturing requires a highly skilled workforce trained in PCB design, soldering, and precision assembly. While some federal STEM funding has been deprioritized, state programs continue to invest in technical education. EMS companies can benefit from partnering with community colleges and vocational schools offering electronics-focused training programs.

Sustainability & Green Electronics Initiatives

EMS companies engaged in renewable energy, battery storage, and EV component manufacturing may face challenges due to reduced federal support for sustainability initiatives. However, state and regional workforce grants remain available for companies focused on green electronics and energy-efficient manufacturing.

How IPC Can Help EMS Companies Secure Workforce Funding

At IPC, we continuously monitor workforce funding sources at all levels to help EMS companies:

- Identify and apply for workforce development grants

- Leverage state and local funding for training initiatives

- Develop strategies to maximize available funding opportunities

While federal funding remains unpredictable, state-driven workforce programs continue to provide critical support for electronics manufacturers. If your company is looking for ways to offset training costs, expand your workforce, or invest in employee upskilling, we’re here to help.

Contact me today to explore funding opportunities for your workforce development needs.

Victoria Hawkins

Director of Workforce Grants and Funding, IPC

Federal grant freezes and shifting national priorities have reduced predictability, though many state programs remain active.

Yes. Many states continue to invest in apprenticeships and structured employer led training for advanced manufacturing roles.

States offer grants for workforce expansion, equipment purchases, training initiatives, and small business development.

CHIPS Act initiatives and state economic development programs support training for high tech manufacturing jobs including PCB and semiconductor related roles.

IPC helps identify grants, prepare applications, and develop strategies to maximize available state and local workforce resources.

IPC WorksAsia - IPC Standards Technical Seminar

The IPC WorksAsia is a technical seminar that IPC focuses on professional fields. It aims to strengthen member interaction and cooperation, promote resource sharing, and help electronics manufacturing enterprises stand out in the competition.

This event will conduct in-depth exchanges and discussions around technical standards, supply chain collaboration, and industry hotspots, helping industry peers understand industry trends and expand cooperation opportunities.

NO.12 Bao tian 1st Road

Bao'an Qu

Shenzhen Shi

Guangdong Sheng, 518102

China

Shenzhen Dayhello International Hotel

Shenzhen Dayhello International Hotel

NO.12 Bao tian 1st Road

Shenzhen Shi, GD 518102

China

IPC APEX EXPO Named One of Trade Show Executive’s Top 100, Class of 2024

Trade Show Executive, the foremost magazine for the trade show industry, recognized IPC APEX EXPO 2024 as one of the top 100 fastest-growing trade shows in the United States for the number of exhibiting companies and net square footage.

IPC APEX EXPO, the largest trade show for electronics manufacturing in North America, hosted 412 exhibitors who engaged in three days of business development, generating 22,552 qualified sales leads on 138,900 net square feet of Anaheim Convention Center show floor space. In addition, the show attracted 7,245 total visitors including attendees and exhibitor personnel, a 5.1 percent increase from 2023.

“This achievement is a testament to the strength and innovation of the electronics industry and the incredible support of our exhibitors, attendees, and partners,” said Alicia Balonek, IPC senior director of trade shows and events. “We are celebrating 25 years of IPC APEX EXPO next month, and we can’t wait to welcome everyone to Anaheim March 15-20.”

According to Trade Show Executive, The Fastest 50 & Next 50 honorees are selected based on the percentage of growth in three categories:

- Net square feet

- Number of exhibiting companies

- Number of attendees.

IPC, along with other honorees will be recognized at The Fastest 50 Awards & Summit, taking place April 30-May 2 in Orlando, an exclusive event for upper-level trade show management, specifically for budgetary influencers and decision-makers.

This year, IPC APEX EXPO will feature more than 400 exhibitors from every step in the electronics manufacturing supply chain, including the industry’s leading equipment manufacturers, suppliers, and product innovators who provide services to help attendees gain greater efficiency while improving their bottom lines.

To view a complete list of companies exhibiting at IPC APEX EXPO, visit www.IPCAPEXEXPO.org/exhibitors. Companies interested in exhibiting can contact Balonek at +1 847-597-2898 or AliciaBalonek@ipc.org.

For more information about the show or to register, visit www.IPCAPEXEXPO.org. Event essentials registration is free to individuals who pre-register online ($50 on-site). To maximize event experience, individuals can take advantage of the All-Access Package which includes all technical conference sessions; five half-day professional development courses; the EMS Leadership Summit, IPC luncheons, and more.

IPC Strengthens Focus in Southeast Asia, Announces New Regional Vice President

IPC, the global electronics association, announces the promotion of Gaurab Majumdar to vice president of Southeast Asia and India. This change underscores IPC’s continued dedication and recent increase in resources and investment to drive growth and innovation in one of Asia's most dynamic and strategically vital hubs for electronics and semiconductor manufacturing.

“Many of our members are rapidly expanding their presence in this region and new players continue to emerge every day,” said Dr. John W. Mitchell, IPC president and CEO. “We are actively striving to enhance industry engagement and build a stronger community around workforce training, government relations, standards development, value chain resiliency, and industry networking.”

Majumdar will be managing the region with the support of 30+ staff members spread out across India, Malaysia, Vietnam, Thailand and the Philippines. He can be reached at GaurabMajumdar@ipc.org.

For more information on IPC’s services in the region, visit https://www.ipc.org/ipc-india.

Leaders of EMS Companies Help IPC Advocate for the Industry

by Rich Cappetto, IPC Senior Director, North American Government Relations

As the U.S. Congress was making progress this week on a budget framework and annual defense authorization and spending bills for the coming year, more than a dozen senior executives from electronics manufacturing services (EMS) companies joined IPC in the nation’s capital for the EMS Leadership Public Policy Roundtable. This two-day event featured expert-led discussions, networking and socializing, and meetings with lawmakers in their offices on Capitol Hill.

The group spent the first day engaging with leading policy experts on issues including the workforce pipeline, taxes, tariffs, and the state of the U.S. and global economy.

Building the Electronics Workforce: Erica Marie Price-Burns of Whiteboard Advisors, Annelies Goger of the Brookings Institution, and Zach Boren of the Urban Institute described the state of play on federal workforce policy and proposals that could help our industry. For example, short-term Pell Grants could be opened up for uses beyond college such as enabling students to pay for certification-based training. The industry leaders in the room reiterated their continuing challenges with replacing older workers as they retire, and the ongoing burden of recruiting and training workers. They shared tips on what has worked in their states, including IPC’s apprenticeships program; internships; and engagements with local community colleges.

Navigating Economic Trends: IPC Chief Economist Shawn DuBravac noted that while recession risks have receded, inflation remains persistent, and the electronics industry continues to experience significant wage pressures. Manufacturing’s share of construction is at an all-time time, with electronics-related manufacturing accounting for nearly 55% of the total.

Surviving Trade Policy Shifts: Noted trade attorney Milla Kasulke of Squire Patton Boggs (SPB) reviewed the latest intelligence and uncertainties surrounding U.S. and global tariffs. The group had a lot to talk about, with executives sharing their concerns, hopes, and ideas on how the industry might adjust, and where engagement with the administration could be helpful.

Anticipating Tax Reform: Finally, former House Ways and Means Committee Staff Director David Stewart and Michael Hawthorn of Squire Patton Boggs examined the high stakes of the intensifying tax policy debate and the implications for EMS businesses. With more than $4.5 trillion in tax cuts and revenue raisers set to expire at the end of 2025, participants commented on which aspects of the tax law present the most opportunities and risks for their businesses.

The next day, participants went to Capitol Hill to educate lawmakers on the importance of supporting a strong and resilient domestic electronics ecosystem. Over the course of a packed day, IPC members met with 15 congressional offices including about a dozen senators and representatives, the House Ways and Means Committee, and the House Republican Conference. Altogether, industry leaders had the opportunity to voice concerns, build relationships, and shape IPC’s advocacy agenda.

The event was also an opportunity for great collaboration between various IPC staff and departments. Special thanks go to Dave Bergman, Thiago Guimaraes, Chris Mitchell, Nyron Rouse, and Mark Wolfe, as well as Jim Will of the U.S. Partnership for Assured Electronics.

If you have any interest in helping IPC promote the industry’s agenda with your elected officials, we invite you to join our ongoing efforts. The IPC Government Relations (GR) Team advocates for you full-time, but our success depends on active feedback and participation from attentive people like you! It really makes a difference.

If you’re interested in helping us advocate for the electronics manufacturing industry, I invite you to reach out to me to learn more. If you haven’t done so already, you can also subscribe to the weekly IPC Global Advocacy Report; peruse our Advocacy pages on IPC.org; and follow any of us on LinkedIn.