Key Summary

- U.S. economic growth remains resilient, but manufacturing continues contracting under tariffs, high input costs, and weakened domestic and export demand.

- U.S. manufacturing PMIs show sustained contraction, declining employment, weak new orders, and margin pressure despite modest production stabilization.

- Eurozone manufacturing weakened further, with falling orders, rising input costs, persistent employment declines, and tariffs intensifying pessimism.

- China manufacturing returned to marginal expansion, driven by short-term stockpiling amid property sector stress and weak consumer demand.

- Asia outside China outperformed, supported by AI and semiconductor demand, export growth, and stronger manufacturing momentum than Western economies.

Welcome to Industry Intelligence Insights, your monthly briefing on the trends, risks, and opportunities shaping the global electronics manufacturing ecosystem.

First, this month’s market analysis from Chief Economist Dr. Shawn DuBravac highlights a growing divergence between resilient headline economic growth and continued strain across global manufacturing. While the U.S. economy continues to expand at a moderate and sustainable pace, factory activity in the United States and Europe remains under pressure, weighed down by tariffs, high input costs, and softer demand.

Also in this issue, you’ll find the latest PCB and EMS Book-to-Bill results, updated global sentiment data showing improving demand conditions, and a regional deep dive into how manufacturers across Europe and Asia are navigating uneven recoveries, supply chain realignments, and AI-driven demand.

We also highlight new resources, including our latest white paper on AI-driven electronics design, recent policy and trade analysis from the Global Electronics Association, and upcoming industry events shaping the year ahead.

Read on for all the latest industry intelligence from the Global Electronics Association.

Thiago Guimarães

Director of Industry Intelligence, Global Electronics Association

Market Analysis from Global Electronics Chief Economist Shawn DuBravac

The broader U.S. economy continues to show notable resilience. Real GDP grew at a strong 4.3% annualized pace in the third quarter of 2025, powered in large part by solid consumer spending. While labor market momentum has cooled, conditions remain relatively tight. The November employment report showed nonfarm payrolls rising by 64,000, with the unemployment rate holding at 4.6%. Inflation also appears well contained. The Consumer Price Index increased 0.2% between September and November and is up 2.7% over the past year, while core CPI rose 2.6%. Taken together, these indicators point to an economy that is expanding at a moderate and sustainable pace.

That underlying strength has not translated into a broad-based recovery in manufacturing. As the new year begins, the U.S. manufacturing sector remains under pressure. The manufacturing PMI fell to 47.9 in December 2025, its lowest reading since October 2024 and the tenth consecutive month below the 50 threshold that separates expansion from contraction. The ISM survey indicates that roughly 85% of manufacturing GDP is contracting, with 43% of industries in strong contraction. New orders remained weak at 47.7, inventories dropped sharply to 45.2 as firms worked down stockpiles, and factory employment declined for the eleventh straight month. Production edged slightly into expansion at 51, but tariffs and geopolitical uncertainty continue to weigh on demand.

A separate survey from S&P Global paints a somewhat less negative, though still cautious, picture. The U.S. Manufacturing PMI eased to 51.8 in December from 52.2 in November, signaling continued expansion but at a slower pace. Output grew modestly, but new orders declined for the first time in a year, and export demand remained soft. Businesses added to inventories and hiring held up, while selling price inflation slowed to its weakest pace since early 2025. Business confidence deteriorated, reflecting growing concern about the outlook.

Taken together, the two surveys suggest that U.S. manufacturing remains subdued. High input costs and tariffs are compressing margins, while demand, particularly from foreign buyers, has softened. Hard data reinforces this view. Factory output was flat in November following a 0.4% decline in October, although production was still 1.9% higher than a year earlier. Employment trends are less encouraging, with manufacturers shedding roughly 63,000 jobs over the course of the year, underscoring the sector’s ongoing struggles.

In Europe, the broader euro zone economy has shown modest resilience despite some weakness. Real GDP growth in the third quarter of 2025 was revised up to 0.3% quarter over quarter, supported by stronger investment and government spending, even as household consumption slowed. Inflation continued to ease, with annual consumer price growth revised down to 2.1% in November, matching October, while core inflation held at 2.4%. The unemployment rate remained steady at 6.4% in October. Services activity and easing inflation are helping to sustain modest growth, even as manufacturing remains a drag.

Manufacturing conditions in the euro zone deteriorated further toward the end of the year. The HCOB Eurozone Manufacturing PMI fell to 48.8 in December from 49.6 in November, its lowest level in nine months. Production declined for the first time in ten months, and new orders fell at the fastest pace in nearly a year. Germany posted the weakest performance among the eight countries surveyed, while Italy and Spain slipped back into contraction. France was a notable exception, recording a 42-month high PMI. Input cost inflation accelerated to a 16-month high, yet firms continued to discount selling prices for the seventh time in eight months. Employment fell for the thirty-first consecutive month, and survey responses point to deepening pessimism as U.S. tariffs bite and global demand slows.

In China, economic growth remains constrained by ongoing stress in the property sector, even as net exports and manufacturing provide partial support. Authorities are targeting around 5% GDP growth in 2026, but most analysts expect growth closer to 2½–3%. Many caution that recent improvements in sentiment may prove temporary. Policymakers continue to deploy targeted stimulus, including measures to support housing and local government finances, while maintaining relatively loose monetary conditions.

China’s official manufacturing PMI rebounded to 50.1 in December 2025 from 49.2 in November, ending an eight-month streak of contraction. The production subindex rose to 51.7, and new orders increased to 50.8, both the strongest readings since March. Export orders, however, remained in contraction at 49.0. The rebound likely reflects pre-holiday stockpiling rather than a durable shift, given persistent property weakness and ongoing overcapacity.

Other economic indicators remain mixed. Industrial output rose 4.8% year over year in November, slightly below October’s 4.9% and short of expectations. Retail sales growth slowed sharply to 1.3% from 2.9%, while fixed asset investment declined 2.6% over the January to November period. Inflation remains very low, with consumer prices up just 0.7% year over year in November, even as food prices returned to positive territory.

Outside China, Asia’s export-oriented economies are benefiting from strong global demand for semiconductors and AI-related products. Singapore’s economy grew 5.7% year over year in the fourth quarter of 2025, lifting full-year growth to 4.8%. Biomedical manufacturing and electronics were key drivers, supported by robust demand for AI-related semiconductors. While 2025 was boosted by front-loading ahead of new U.S. tariffs, policymakers caution that growth could slow in 2026 if trade pressures intensify. Inflation across the region is mixed. Japan’s core inflation remained near 3% in November, above the Bank of Japan’s 2% target, while South Korea’s inflation has eased to around 2%, giving policymakers room to hold rates steady.

Overall, Asia’s manufacturing hubs ended 2025 in stronger shape than their counterparts in the United States and Europe. Manufacturing activity rebounded in several economies as export orders improved, and demand for AI-related hardware accelerated. Export growth has surged across much of the region, and the near-term outlook for Asia’s export-oriented manufacturers remains relatively favorable.

Southeast Asia continues to post steady growth, though momentum has moderated. Indonesia’s manufacturing PMI eased to 51.2 in December from November’s nine-month high of 53.3, marking the fifth consecutive month of expansion. New orders and employment grew more slowly; foreign sales declined for a fourth month, and capacity pressures persisted. Input costs remained elevated, though inflation in those costs eased to a four-month low, and business confidence improved.

Vietnam also recorded a modest slowdown, with its PMI dipping to 53.0 from 53.8 in November. Output expanded for an eighth consecutive month, supported by continued growth in new orders. Supply disruptions from storms and flooding weighed on activity, while employment rose to address backlogs. Input costs surged at the fastest pace since mid-2022 and firms passed those costs through to customers. Despite these pressures, business sentiment strengthened to its highest level since March 2024. Together, Indonesia and Vietnam illustrate how Southeast Asian manufacturers are navigating supply disruptions and tariffs while benefiting from shifting supply chains and AI-driven demand.

India remained Asia’s fastest-growing major manufacturing economy, though signs of cooling are emerging. The HSBC India Manufacturing PMI slipped to 55.0 in December, down from 56.6 in November and marking the weakest improvement in two years. New orders and export growth softened, with export demand expanding at its slowest pace in fourteen months. Employment growth was marginal as firms judged current staffing levels sufficient, and business confidence fell to its lowest level in nearly three and a half years. Even so, with the PMI well above 50, manufacturing activity in India remains firmly expansionary.

Recent data highlight a clear divergence across the global manufacturing landscape. The United States and Europe remain in contraction, weighed down by tariffs, high input costs, and softer demand. U.S. factories face their most challenging conditions since late 2024, while euro zone manufacturers report falling orders and rising costs. China’s manufacturing sector has returned to marginal growth, but the rebound appears tentative and likely driven by short-term factors. In contrast, Asia outside China stands out as the bright spot. Japan’s factory sector has stabilized, India continues to expand despite slower momentum, and South Korea and Taiwan have returned to growth as global technology demand rebounds. Southeast Asia continues to grow, though at a more measured pace.

Looking ahead, global manufacturing will continue to contend with tariffs, supply chain realignments, and weakening demand from Western economies. Asian exporters appear better positioned to benefit from the AI and semiconductor cycle, but they remain vulnerable to shifts in U.S. policy and global demand. While the broader economy continues to expand in most regions, supported by services activity and resilient consumers, the persistent gap between manufacturing and the rest of the economy underscores the uneven nature of the recovery.

Book to Bill

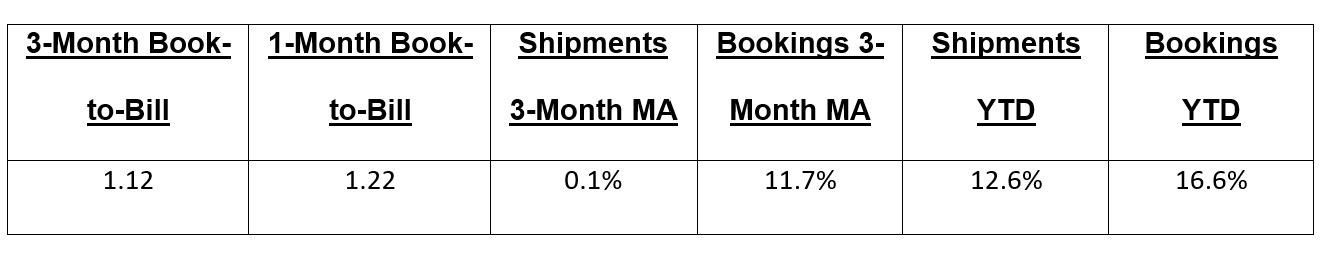

PCB: November PCB Data Signals Sustained Growth as Book-to-Bill Remains in Expansion

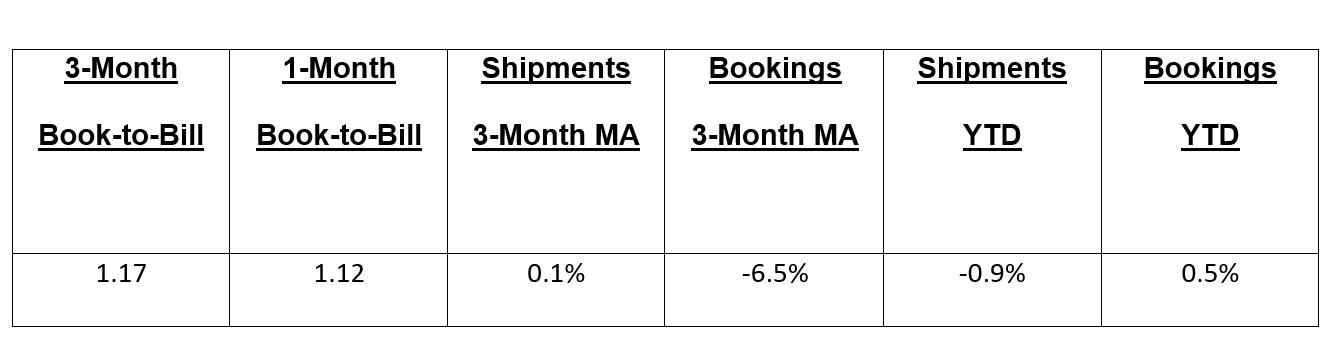

EMS: November EMS Data Shows Short-Term Pullback but Book-to-Bill Signals Underlying Stability

Global Sentiment

The Current Sentiment of the Global Electronics Manufacturing Supply Chain

The December 2025 Global Sentiment Report shows that all measures of demand strengthened in December, pushing overall demand to its highest level since 2022. The Backlog Index rose to 100, edging out of contraction for the first time since August. The New Orders Index posted a notable increase, while both the Capacity Utilization Index and the Shipments Index also moved higher.

Recent Reports

The Transformation of A.I.-Driven Electronics Design: Redefining Processes, Skills, and Standards in Electronics Development

This new white paper from the Global Electronics Association examines the evolution, implementation challenges, and future trajectory of AI in electronics design, emphasizing how innovation, validation, and human oversight must evolve together.

Articles

USMCA Review: A Critical Opportunity to Fortify North American Electronics

By Chris Mitchell, Chief Advocacy Officer

Global Electronics Association Calls for Expansion of EU Chips Act to Support Critical Industries

A new blog from the Global Electronics Association.

Social Media

A proportionate, risk-based approach is urgently needed to address functional-critical PFAS in electronics, especially fluoropolymers and other materials with no viable alternatives. Watch this video to learn what’s coming, what’s required, and how to help represent the voice of the global electronics industry on PFAS

- March 16–19, 2026 — APEX EXPO, Anaheim, California: The Global Electronics Association’s flagship event will feature keynote addresses from IBM Quantum’s David Lokken-Toyli, futurist Zack Kass, and Association President & CEO John W. Mitchell, offering bold insights on quantum computing, artificial intelligence, and the future of global electronics innovation. Register HERE