Building Bridges Across the Seine: Europe's EMS Leadership Gathers in Paris

Key Summary

• More than 90 EMS and PCB executives gathered in Paris for the EMS Presidents’ Dinner, hosted by the Global Electronics Association with in4ma and IFTEC.

• The event emphasized collaboration across Europe’s electronics ecosystem amid rising industry complexity and global challenges.

• The following day’s IPC Day EMS Europe offered technical discussions and strategic insights, with over 60% C-level participation.

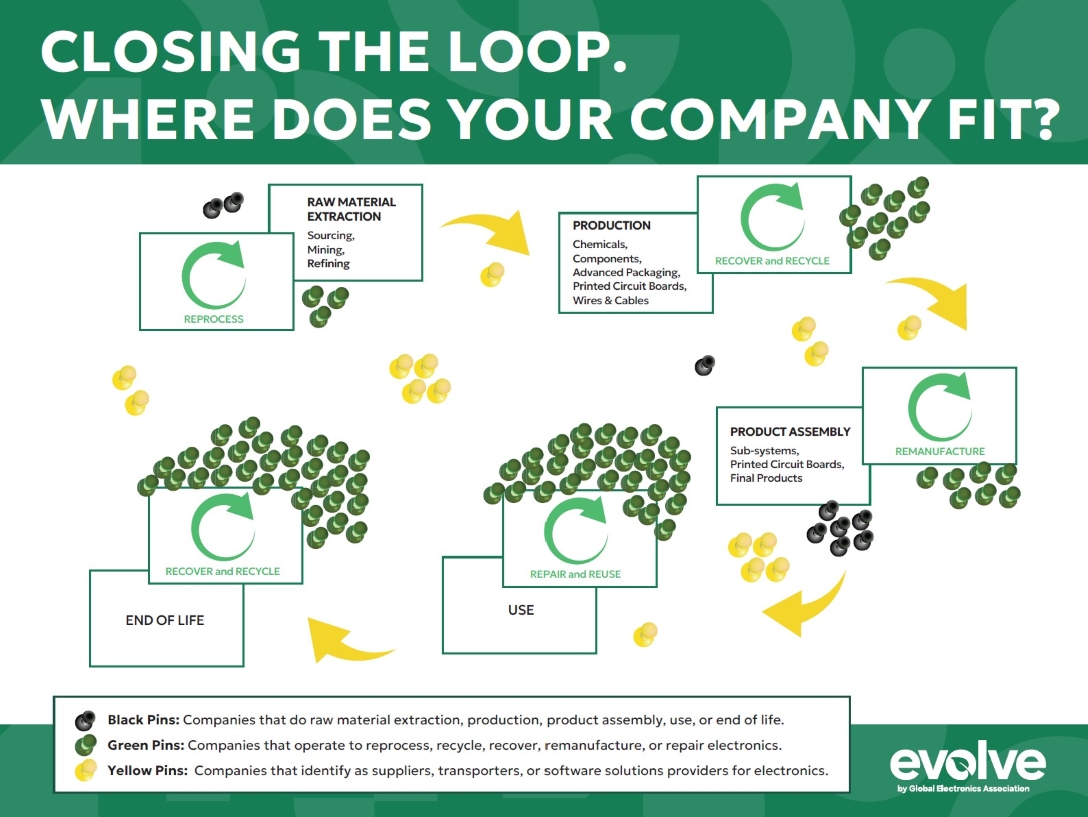

• Key themes included supply chain resilience, advanced packaging, workforce development, sustainability, and standardization.

• The two-day experience reinforced the strategic importance of leadership alignment for Europe’s EMS sector.

On the eve of IPC Day EMS Europe, more than 90 executives from leading EMS and PCB manufacturing companies came together aboard the elegant Onyx cruise ship for the EMS Presidents’ Dinner. Hosted by the Global Electronics Association in partnership with in4ma and IFTEC, the exclusive evening offered a unique mix of networking, knowledge exchange, and cultural experience.

In welcoming remarks, Philippe Leonard, the Director for the Association in Europe, highlighted the importance of collaboration across the electronics ecosystem at a time when the industry faces increasing complexity and global challenges. His message set the tone: strengthening connections to drive innovation, resilience, and growth in Europe’s EMS sector.

Beyond the dialogue, the event provided attendees with an unforgettable backdrop. The setting reminded participants that business relationships, like the city itself, are strengthened by history, vision, and renewal.

The EMS Presidents’ Dinner framed the next day’s IPC Day EMS Europe event at the Astrolab in the Musée de la Marine in Paris, where attendees shared deeper technical discussions, strategic insights, and industry alignment.

60% of the 100+ attendees were C-level executives: CEOs, CTOs, owners, and senior leaders from Europe’s leading EMS and PCB manufacturing companies. This impressive representation reinforced the importance of IPC Day EMS Europe as a strategic forum for leadership-driven dialogue. Whether through advancing technical standards, addressing labor market realities, or reinforcing Europe’s strategic position in global supply chains, the day showcased both the urgency and opportunity ahead.

From the opening keynote to the final expert panel, the agenda covered the most pressing issues shaping the future of electronics in Europe:

Supply chain resilience and regional consolidation

Advanced electronics packaging and innovation

Workforce development and talent acquisition

Sustainability, standardization, and advocacy

The Global Electronics Association would like to thank all sponsors, attendees, and staff for making this event a success.

Follow - Global Electronics Association Europe LinkedIn

Photo Credits: Jean Haeusser

Global Electronics Association Event Sponsors

It brought together EMS and PCB manufacturing leaders for networking, knowledge sharing, and strengthening collaboration across Europe’s electronics ecosystem.

The Global Electronics Association, in partnership with in4ma and IFTEC.

More than 90 attendees joined the dinner aboard the Onyx cruise ship, providing a memorable setting and meaningful discussions before IPC Day EMS Europe.

Key issues included supply chain resilience, advanced electronics packaging, workforce development, sustainability, standardization, and the industry’s strategic position in global supply chains.

Over 100 attendees participated, with 60% being C-level executives from leading EMS and PCB companies across Europe.