North American PCB Industry Sales Up 3.4 Percent in May

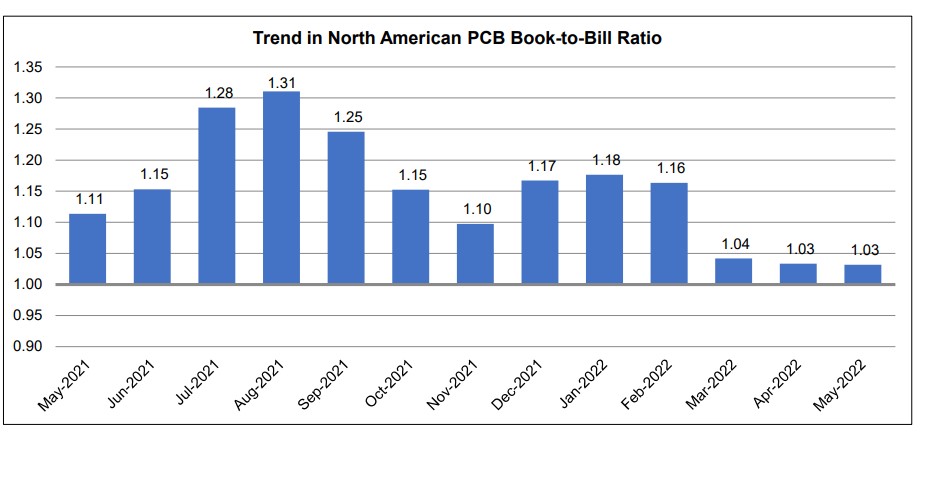

IPC announced today the May 2022 findings from its North American Printed Circuit Board (PCB) Statistical Program. The book-to-bill ratio stands at 1.03.

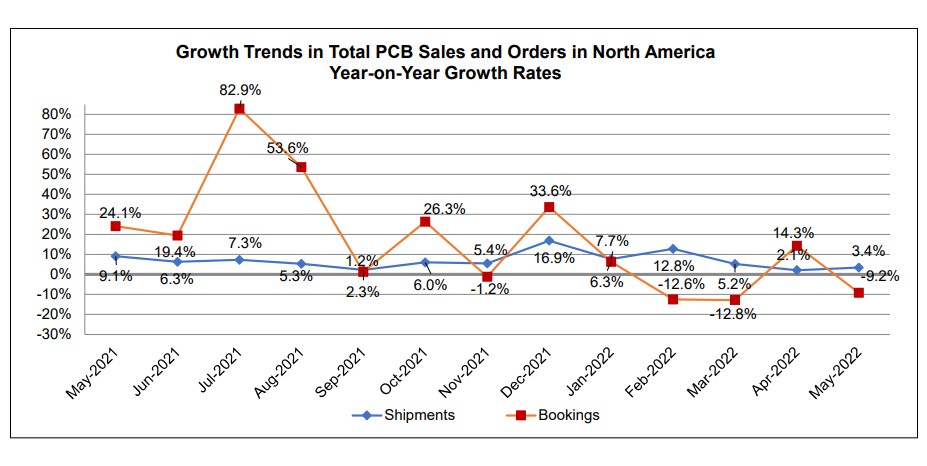

Total North American PCB shipments in May 2022 were up 3.4 percent compared to the same month last year. Compared to the preceding month, May shipments rose 1.1 percent.

PCB year-to-date bookings in May were down 9.2 percent compared to last year. Bookings in May fell 10.3 percent from the previous month.

“PCB demand remains strong and is showing some signs of normalization,” said Shawn DuBravac, IPC’s chief economist. “Order flow is slowing and shipments are picking up, bringing the book-to-bill into a more normal range.”

Detailed Data Available

Companies that participate in IPC’s North American PCB Statistical Program have access to detailed findings on rigid PCB and flexible circuit sales and orders, including separate rigid and flex book-to-bill ratios, growth trends by product types and company size tiers, demand for prototypes, sales growth to military and medical markets, and other timely data.

Interpreting the Data

The book-to-bill ratios are calculated by dividing the value of orders booked over the past three months by the value of sales billed during the same period from companies in IPC’s survey sample. A ratio of more than 1.00 suggests that current demand is ahead of supply, which is a positive indicator for sales growth over the next three to twelve months. A ratio of less than 1.00 indicates the reverse.

Year-on-year and year-to-date growth rates provide the most meaningful view of industry growth. Month-to-month comparisons should be made with caution as they reflect seasonal effects and short-term volatility. Because bookings tend to be more volatile than shipments, changes in the book-to-bill ratios from month to month might not be significant unless a trend of more than three consecutive months is apparent. It is also important to consider changes in both bookings and shipments to understand what is driving changes in the book-to-bill ratio.

IPC’s monthly PCB industry statistics are based on data provided by a representative sample of both rigid PCB and flexible circuit manufacturers selling in the USA and Canada. IPC publishes the PCB book-to-bill ratio by the end of each month.