Key Summary

• The August 2025 issue highlights weakening U.S. economic momentum and tariff-driven inflation pressures.

• North American PCB and EMS shipments declined, but book-to-bill ratios remain strong, signaling ongoing demand.

• Global sentiment improved modestly, with better expectations for shipments, orders, and capacity utilization.

• New intelligence briefs focus on copper tariff impacts, AI policy, EMS software gaps, and global production patterns.

• Upcoming events include EMS roundtables and European market presentations across Switzerland, Sweden, Poland, and France.

Welcome to Industry Intelligence Insights, your monthly guide to the trends and data shaping the global electronics manufacturing landscape. I’m Thiago Guimarães, Director of Industry Intelligence at the Global Electronics Association, and I’m pleased to share the latest updates.

This month’s issue arrives at a time of growing uncertainty across the global economy. Our Chief Economist, Dr. Shawn DuBravac, examines a weakening U.S. outlook, where tariffs and trade are the focus.

Against this backdrop, we share new data on North American PCB and EMS markets, which show softening shipments but resilient demand. We also spotlight July’s global sentiment report, our latest intelligence brief on the rising costs of copper tariffs, and expert analysis on U.S. AI policy, EMS software gaps, and the hidden geography of electronics production.

Read on for timely intelligence to help you navigate what’s ahead.

Thiago Guimarães

Director of Industry Intelligence, Global Electronics Association

Market Analysis from Global Electronics Chief Economist Shawn DuBravac

Yes, U.S. economic growth remains technically positive, but momentum is clearly fading. While the economy remains in expansion, the vigor that defined 2024 has ebbed. Real GDP contracted at a 0.5% annualized rate in Q1 2025 before rebounding to 3% in Q2. A rush to import goods ahead of new tariffs dampened growth in Q1 and temporarily inflated it in Q2. Volatility in trade flows is masking underlying economic weakness. Averaged across both quarters, GDP grew just over 1% in the first half of 2025, a sharp drop from nearly 3% in 2024. Final sales to private domestic purchasers, a key measure of underlying demand watched by the Fed, slowed to 1.2% from 1.9% in the prior quarter, marking the weakest pace since Q4 2022.

In 2025, real personal consumption expenditures (PCE) have shown clear signs of weakening. After growing just 0.5% (annualized) in Q1, real PCE rebounded modestly to 1.4% in Q2, indicating soft consumer momentum. Much of this growth has been concentrated in services, while goods spending has stagnated or declined. On a monthly basis, real PCE was nearly flat in both May and June, with a 0.1% rise in June barely reversing May’s drop. Overall, consumer demand has slowed notably compared to 2024, reflecting the combined weight of inflation, higher borrowing costs, and tariff-driven price increases.

Inflation is beginning to reflect the tariff shock. Core PCE rose to 2.8% year-over-year in June, marking the third consecutive monthly increase. Most of the upward pressure came from goods categories either directly subject to tariffs or affected indirectly through global supply chains. According to Yale’s Budget Lab, the average U.S. statutory tariff rate is set to reach 18.2%, its highest level since the 1930s, once the August 7 tranche is implemented. Historically, inflationary pass-through tends to peak 6 to 9 months after duties are enacted. If that pattern holds, the most significant inflationary drag will land during the critical holiday season, just as households face tighter budgets.

Job growth is also slowing and becoming increasingly concentrated. The July payroll report showed a gain of just 73,000 jobs, the weakest since the pandemic recovery, while the unemployment rate ticked up to 4.2%. Over the past three months, average monthly job gains have slumped to just 35,000. Hiring remains strong in health care and government, but manufacturing, transportation, and other cyclical sectors are now shedding jobs. While layoffs remain low, employers appear to be pausing hiring, a classic late-cycle signal.

The Federal Reserve is in a bind. The Fed has held its policy rate between 4.25% and 4.50%, caught between persistent inflation and weakening labor market data. Policymakers insist cuts are unlikely until there is clear evidence of slack, rising unemployment, and outright job losses. With core PCE at 2.8% and tariff pressures building, the room for easing is limited. Markets are currently pricing in a 75% to 80% chance of a rate cut by September following the soft jobs report, but Fed officials such as San Francisco’s Mary Daly have warned against acting prematurely, arguing that early cuts risk re-anchoring inflation expectations.

There is a narrow Path to avoid contraction. The U.S. economy is teetering on a knife’s edge as it approaches 2026. Avoiding contraction remains possible but will require a precisely calibrated policy response. First, inflation must cool decisively. That means containing tariff pass-through and bringing core PCE below 2.5%, enabling the Fed to cut rates without jeopardizing credibility. If unemployment moves sharply higher, the Fed may have scope to cut more aggressively. This policy mix could sustain soft-landing conditions, but it demands timing, coordination, and a delicate balance.

The risk of a hard landing is intensifying. A scenario in which tariffs escalate further could provoke retaliatory trade barriers, disrupting exports and global supply chains. Inflation would remain sticky, particularly as input costs rise across imported goods, constraining the Fed’s ability to respond even as growth falters. In this setting, stagflation becomes the most acute macroeconomic threat, a combination of elevated inflation, rising unemployment, and declining output.

Bottom line, the U.S. economy faces a narrowing window to engineer a soft landing. The illusion of Q2 strength is already fading, replaced by mounting evidence of stagnation. Without a meaningful reversal in trade policy or timely fiscal support, the baseline scenario is shifting from a slowdown toward a mild recession by early 2026.

Book to Bill

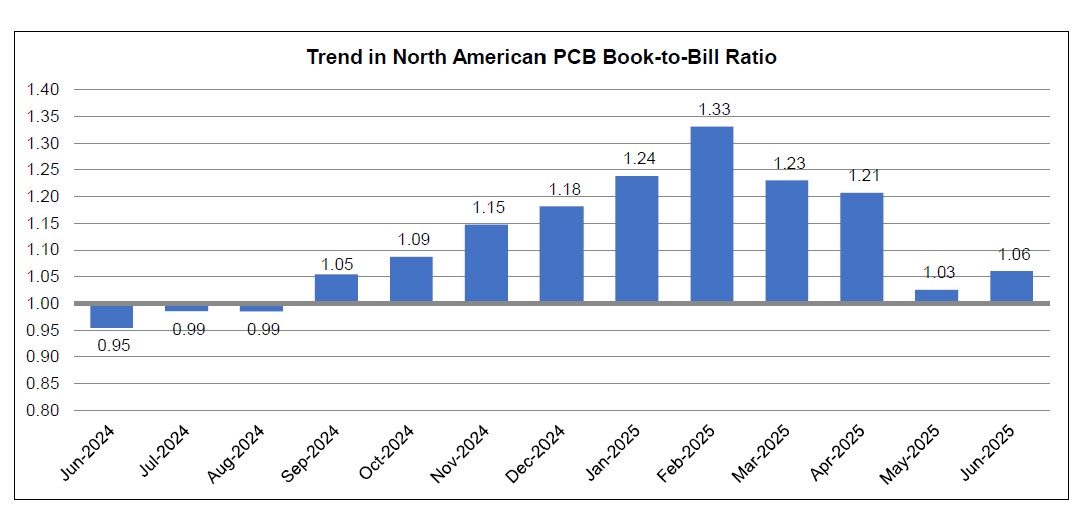

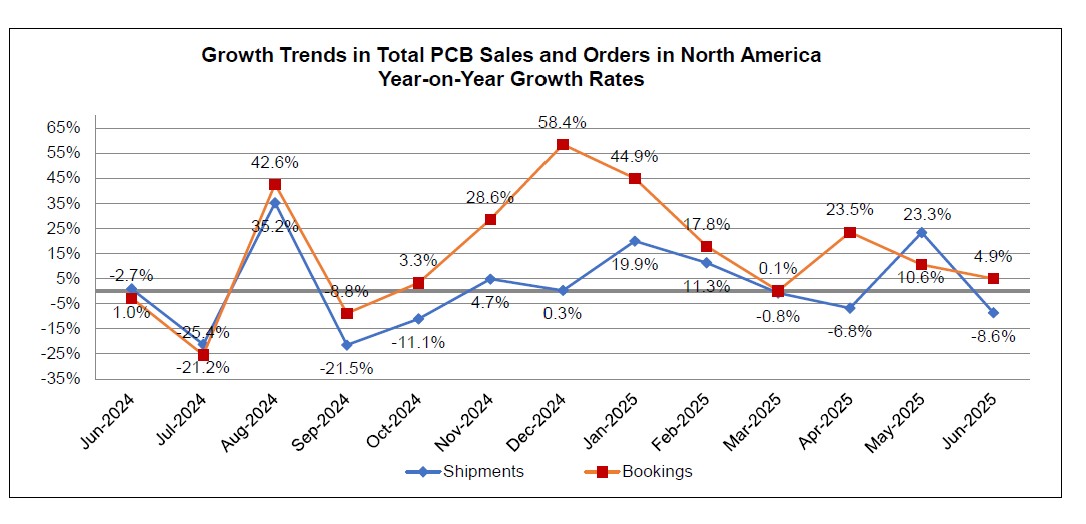

PCB: North American PCB Industry Sales Down 8.6 Percent in June

North American PCB shipments fell 8.6% year-over-year in June, with month-over-month bookings also down slightly. Despite the dip, a book-to-bill ratio of 1.06 signals continued demand strength and confidence in future growth.

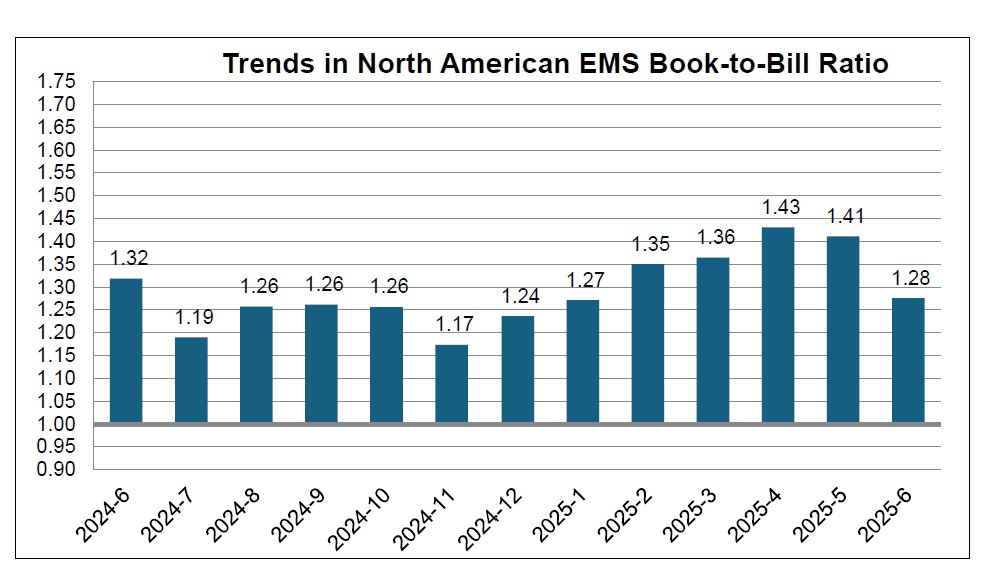

EMS: North American EMS Industry Shipments Down 9.3 Percent in May

North American EMS shipments fell 9.3% year-over-year in May, while bookings rose modestly compared to last year. A strong book-to-bill ratio of 1.43 reflects sustained demand and signals potential for shipment recovery in the coming months.

Global Sentiment

The Current Sentiment of the Global Electronics Manufacturing Supply Chain

July 2025 Global Sentiment: Despite persistent pressure from rising input costs, the outlook for shipments, orders, and capacity utilization improved over the month, indicating that while current conditions remain challenging, future industry expectations strengthened

Recent Reports

Market Intelligence Capabilities

The Global Electronics Association delivers data-driven insights that help decision-makers understand, anticipate, and shape the future of the electronics industry.

Industry Intelligence Brief: Copper Tariffs and the Hidden Costs to U.S. Electronics Manufacturing

This brief underscores significant supply chain risks and urges policymakers to exempt critical copper inputs to preserve U.S. competitiveness and support manufacturing resilience.

Blogs/Other Write Ups

U.S. AI Action Plan Should Revive Focus on the Electronics Inside by Chris Mitchell

The Global Electronics Association welcomed the Trump Administration’s National AI Action Plan, calling for renewed investment in domestic electronics manufacturing as a critical foundation for AI leadership.

Articles

The Hidden Geography of Electronics by Shawn DuBravac

Beneath the surface of debates about reshoring, tariffs, and supply chain resilience lies a deeper reality: Global electronics manufacturing is increasingly driven by the flow of inputs, not just the shipment of final goods.

What EMS Firms Want From Their Software—and What They Get by Thiago Guimaraes

Exploring the gap between EMS providers’ software expectations, centered on integrated production planning, quality control, and real-time data, and the actual capabilities delivered by many current solutions.

Upcoming Events:

- August 13, 2025 -- Texas/Dallas Area EMS Leadership Roundtable: Bot or Not? AI, Automation, and Assembling the Workforce of the Future

- August 29, 2025—Swiss Electronic Networking Day, Zurich, Switzerland: Global Electronics Association’s Christoph Solka will give a presentation on the European EMS market.

- September 4, 2025—Evertiq Expo, Gothenburg, Sweden: Global Electronics Association’s Christoph Solka will present on the European EMS market.

- September 11, 2025 — TEK Day Gdansk, Poland: Global Electronics Association’s Christoph Solka will be giving a presentation on the European EMS market.

- September 17/18, 2025 — IPC Day (EMS) Paris, France